Term Life Insurance: How It Works - Insure.com

Term life insurance coverage, also called pure life insurance, is a kind of life insurance that guarantees payment of a mentioned death benefit if the covered individual passes away during a specified term. Once the term ends, the insurance policy holder can either restore it for another term, convert the policy to long-term coverage, or enable the term life insurance policy to terminate.

Term life insurance guarantees payment of a stated death benefit to the insured's recipients if the guaranteed individual passes away throughout a defined term. These policies have no value aside from the ensured death benefit and function no cost savings component as found in a whole life insurance coverage product. Term life premiums are based upon a person's age, health, and life expectancy.

When you purchase a term life insurance policy, the insurance provider figures out the premiums based upon the worth of the policy (the payment quantity) along with your age, gender, and health. Sometimes, a medical examination might be required. The insurer might also ask about your driving record, existing medications, cigarette smoking status, occupation, pastimes, and household history. If you pass away throughout the regard to the policy, the insurer will pay the face value of the policy to your recipients. This money benefitwhich is, in many cases, not taxablemay be used by beneficiaries to settle your healthcare and funeral service costs, consumer financial obligation, or mortgage debt amongst other things.

You may have the ability to renew a term policy at its expiration, but the premiums will be recalculated for your age at the time of renewal. Term life policies have no value besides the guaranteed death advantage. There is no cost zanderdmyf200.timeforchangecounselling.com/how-combining-term-and-permanent-life-insurance-results-in savings element as discovered in a entire life insurance item.

Interest rates, the financials of the insurance provider, and state guidelines can also impact premiums. In general, companies frequently provide better rates at "breakpoint" coverage levels of 00,000, $250,000, $500,000, Home page and ,000,000.

There are numerous different types of term life insurance; the very best choice will depend on your private scenarios.

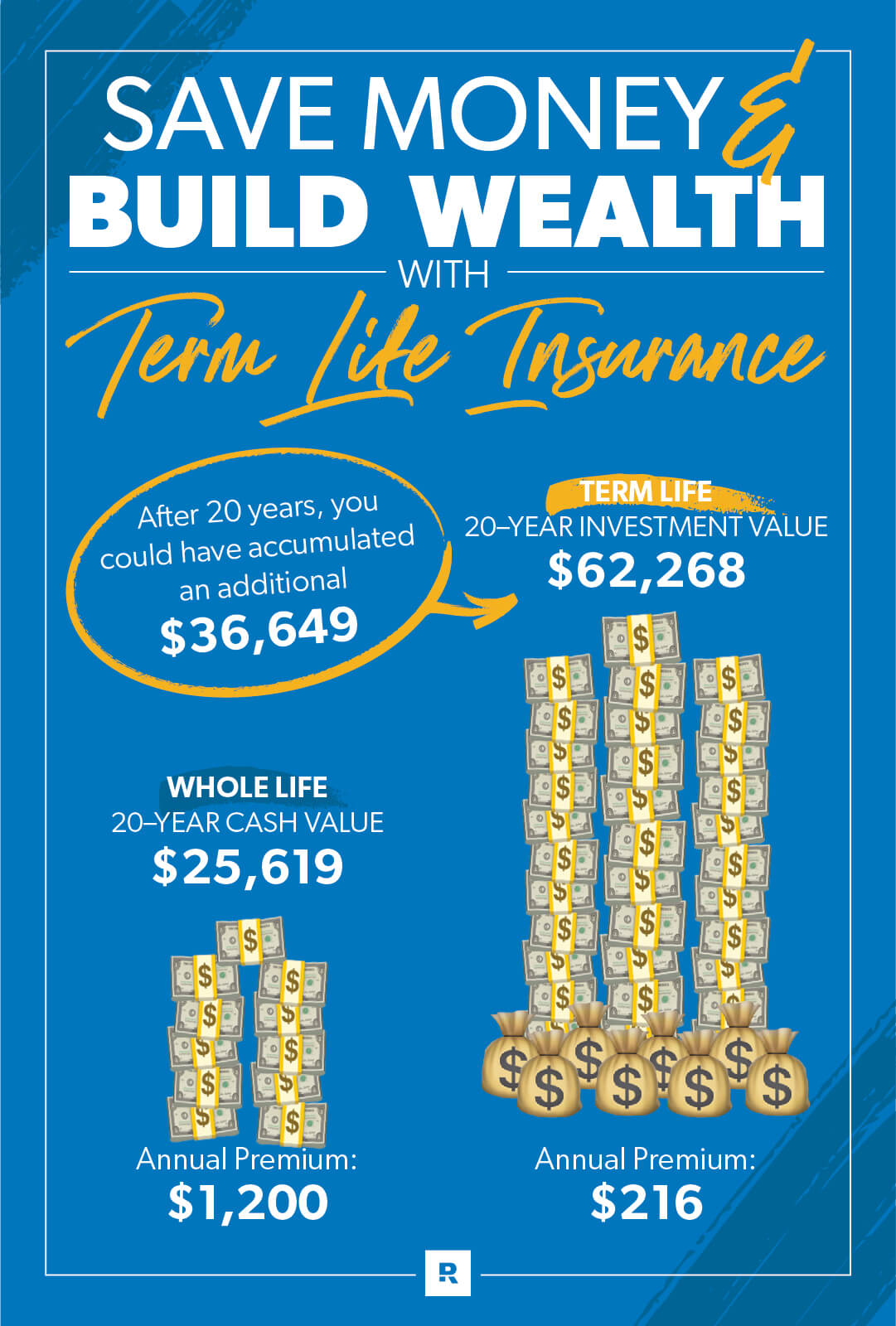

The primary distinctions in between a term life insurance policy and Get more info a long-term insurance plan, such as universal life insurance coverage, are the duration of the policy, the accumulation of a Find more info money value, and the cost. The best choice for you will depend upon your needs; here are some things to think about.

Term life policies are ideal for individuals Extra resources who desire significant coverage at low costs. Entire life customers pay more in premiums for less coverage but have the security of knowing they are protected for life. While lots of purchasers prefer the price of term life, paying premiums for an extended duration and having no benefit after the term's expiration is an unsightly feature. Upon renewal, term life insurance coverage premiums increase with age and might end up being cost-prohibitive in time. In reality, renewal term life premiums might be more costly than irreversible life insurance coverage premiums would have been at the concern of the original term life policy.